This is the third and final entry of the tax declaration guide on tax deductions. We’ll cover all forms in ‘other deductions’ (Sonstige Abzüge). These are:

- Charitable donations

Gemeinnützige Zuwendungen - Illness and accident costs

Krankheits- und Unfallkosten - Disability related costs

Behinderungsbedingte Kosten - Additional deductions

Weitere Abzüge

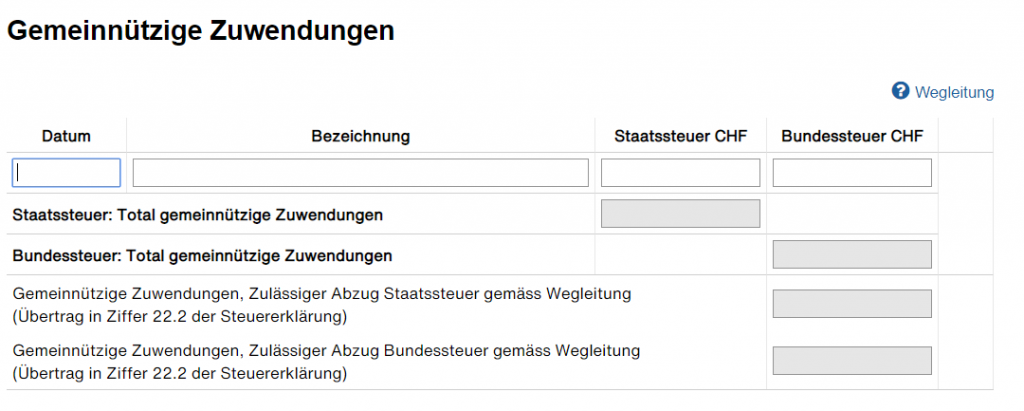

Charitable donations

Gemeinnützige Zuwendungen

You can deduct donations if they exceed CHF 100. My understanding is that this is in total (not per donation). Which donations can you deduct? The guidelines mention donations to:

- The Swiss Confederation

- Cantons

- Municipalities

- Non-for-profits

I’m unsure if other entities are eligible. If in doubt, you should contact your tax office. In addition, the beneficiary must be a Swiss based legal persons. There’s also a cap at 20% of the declared net income. As usual, you must upload proof.

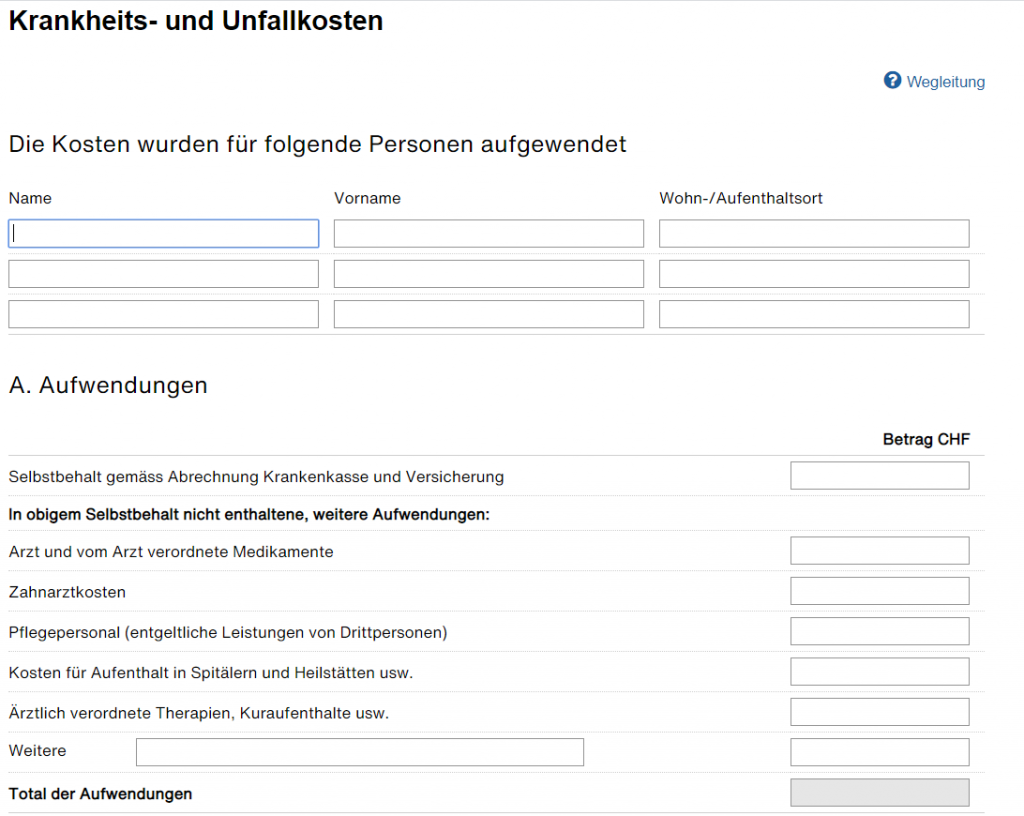

Illness and accident costs

Krankheits- und Unfallkosten

You can deduct expenses related to an illness or accident. This applies to any of your dependents as well. Just write the details on the top form.

You can only deduct medical (or dental) expenses that are prescribed by a doctor. And even in this case, expenses must be higher than 5% of your declared net income. Below this threshold, no deduction is possible. You can find additional info here (official source, pdf below) and here (in English). With that said, let’s cover all four forms.

Form A

You should load all your applicable illness or accident expenses in this form:

- Deductible, assuming it was fully used

Selbstbehalt gemäss Abrechnung Krankenkasse und Versicherung - Doctor appointments and prescribed meds

Arzt und vom Arzt verordnete Medikamente - Dental expenses

Zahnarztkosten - Nursing services (paid to third parties)

Pflegepersonal - Hospital (or equivalent) costs

Kosten für Aufenthalt in Spitälern und Heilstätten usw. - Medically prescribed therapies, spa stays, etc.

Ärztlich verordnete Therapien, Kuraufenthalte usw. - Other expenses

Weitere

Form B

Indicate here the share of your expenses covered by third parties. The fields are:

- Insurance

Krankenkasse /Versicherung - Contributions to living expenses (e.g. nutrition)

Anteil Lebenshaltungskosten, z.B. Ernährung - Other

Weitere

Make sure you’re exhaustive in here. Any contribution not fitting into the first two fields should go into ‘other’.

Form C

Form C is automatically calculated based on forms A and B. It computes the net expenses after deducting all third-party contributions.

Form D

You can use this form to deduct a flat amount of CHF 2,500 if you follow a especial diet. The German term is ärztlich angeordneten Diät oder Spezialnahrung.

The diet must be medically prescribed. The guidelines give celiac disease as an example. There’s more info available in the pdf above. Contact the tax office if you think you have a condition that fits here but isn’t listed.

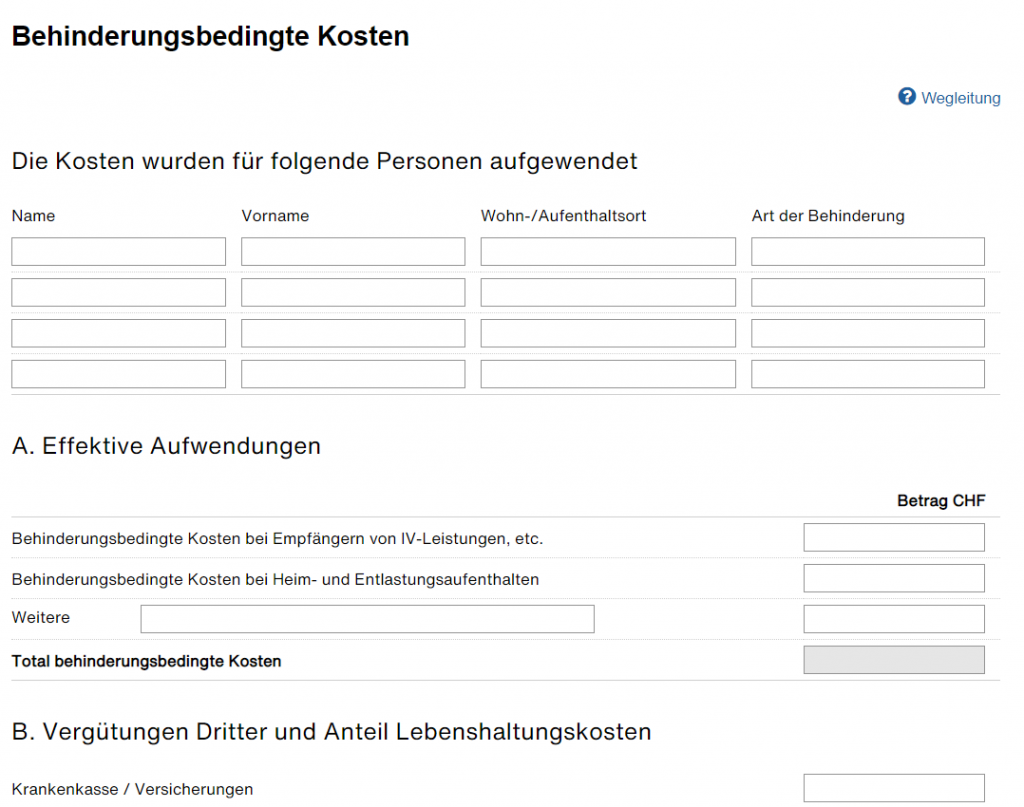

Disability related costs

Behinderungsbedingte Kosten

You can deduct costs related to a disability. Same as with medical costs, this applies to any of your dependents as well. Just write the details on the top form.

There’s four forms in this section.

Form A

Write here your total effective expenses. This applies to both:

- Recipients of IV benefits

Behinderungsbedingte Kosten bei Empfängern von IV-Leistungen, etc. - Individuals that stay at home or at other relief facilities Behinderungsbedingte Kosten bei Heim- und Entlastungsaufenthalten

Write expenses not belonging to either category under ‘other’ (Weitere).

Form B

Indicate here the share of your expenses covered by third parties. These might be:

- Insurance

Krankenkasse/Versicherung - Disability allowances

Hilflosenentschädigungen - Contributions to living examples such as accommodation, clothing and nutrition

Anteil Lebenshaltungskosten (z.B. Ernährung, Bekleidung, Unterkunft) - Other

Weitere

Form C

This form is automatically calculated based on forms A and B. It computes the net expenses after deducting all third-party contributions.

Form D

You can use this form for additional disability-related deductions. These are all flat-rate deductions. The rules for how they work are explained once again here (link to pdf in previous section).

The flat rate deduction depends on the allowances received:

- Minor disability allowance: CHF 2,500

- Medium disability allowance : CHF 5,000

- Severe disability allowance : CHF 7,500

You can deduct additional CHF 2,500 if you’re deaf or undergo dialysis. This is irrespective of any other allowances.

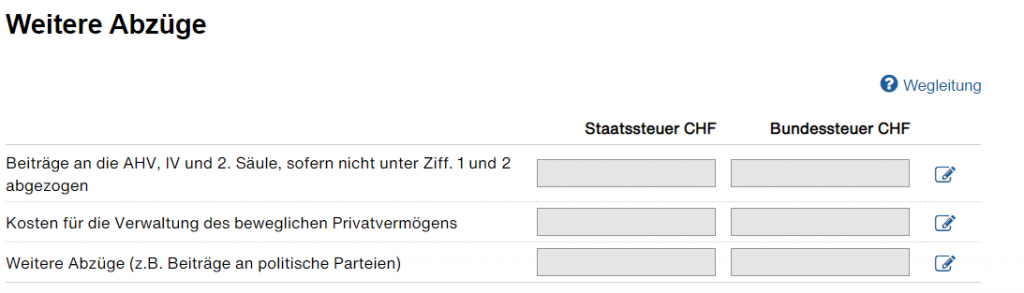

Additional deductions

Weitere Abzüge

There’s three final deductions to consider before closing off this theme.

Contributions to AHV, IV or pension fund (pillar 2) not yet considered

Beiträge an die AHV, IV und 2. Säule, sofern nicht unter Ziff. 1 und 2 abgezogen

This one is quite self-explanatory. Do you have any contributions to pillar 2, AHV or IV not listed up until now? Then write them here. And attach proof to the tax return.

Costs of management of private movable assets

Kosten für die Verwaltung des beweglichen Privatvermögens

This is an interesting one. The Swiss tax authorities allow for a 0.3% flat rate tax deduction on your private movable assets if you pay any sort of third-party admin fees fees. No questions asked. This applies (but is not limited to) ETF/stock investments through pretty much any broker. Including Interactive Brokers (IB) or Degiro.

You apply the 0.3% rate on the value of your securities. Cash is excluded. Let’s look at an example. Say you have 15k in your Swiss bank account, and additional 65k on IB. 12k out of which is cash. The rest are ETFs. Assume this is all your wealth. How much can you deduct? CHF 159. Why? Because you only consider the value of the funds. That’s 53k * 0.003.

The cap for this deduction is CHF 6,000. Which means that you benefit from it up until CHF 2 million in invested assets.

Were your expenses above 0.3%? You can also claim them, but you’ll need to attach proof. You should probably also change brokers, by the way.

Note that, starting tax year 2020, this deduction lowers the DA-1 tax returns. More info here.

Other deductions

Weitere Abzüge

The main example here is contributions to political parties. I don’t know of any other example. There’s some very specific conditions for these contributions to be deductible. They’re clearly explained in the guidelines.

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on January 6, 2022

4 replies on “Tax declaration guide (3/6): Abzüge [3/3]”

Hello, the part around securities is not very clear. Is the 0,3% calculated only based on the value of the ETF or also company stocks? If I have 10.000 CHF in say Amazon stock, can I deduct 30 CHF ?

Hi John and apologies for the late reply. AFAIK yes, this applies to any “private movable assets”, which includes stocks. I updated the post to make it clearer.

Hello,

Which section shall be used to specify childcare costs?

If parents have joint custody and they are not married, can the amount be split 50-50 in each respective declaration?

Alimonies and pensions to others (Unterhalt und Renten), explained here