Investing means to allocate money in the expectation of a future benefit. It’s a core pillar of your personal finance. But before you invest in any financial product, you should invest in your own financial literacy. This entry level guide will provide you with the essential background knowledge that you need before you start your investing journey.

Why to invest

Why should you invest? Because investing helps you fulfill your financial goals. Whatever they are. Doesn’t matter if you intend to buy an expensive house, send your kids study abroad or retire early. Investing helps you meet your financial goals in two different ways: by earning an income and by shielding against inflation.

Earning an income

In general, there are two ways to make money. The first one is working. When you work, you trade your time for money. The second one is investing. When you invest, you trade your wealth for an expected future profit.

People with low financial literacy tend to neglect investing as a means to make money. But, in fact, rich individuals build their wealth through investing. Not via salary accumulation.

To illustrate, I don’t know of a single billionaire in the world who got to be one by stacking payslips. They became billionaires because of their investments. In fact, Bezos’ salary is around $80k [1]. On his salary, it would take more than a million years to surpass the $100bn threshold. Yet his net worth is higher than that. Bezos fortune doesn’t come from his paychecks. It comes from the increase in value of his assets.

You’ll likely never be a billionaire. But you don’t have to in order to benefit from investing. Investing will help you build wealth. Same as it does for billionaires.

Shielding against inflation

If you keep your savings as cash, inflation will eat them away. Period. This isn’t even a risk. This is a certainty. Long term, inflation is a much bigger threat than market crashes.

Inflation is taxation without legislation

Milton Friedman

The last ~30 years have been relatively mild in terms of inflation. Yet look at what happened to the purchasing power of 30,000 worth of cash in different currencies.

Source: OECD data

The purchasing power of the USD has halved since 1990. On average, whatever USD 30k had bought you in 1990, they only bought you half in 2018. Inflation on EUR and CHF is a bit milder, but still pretty significant. Inflation is a permanent threat for your cash holdings.

Most investment options protect you against inflation. Partially at the very least. For example, stock prices go up as company revenues ‘inflate’ with inflation. Bonds yields factor in inflation expectations. And real estate, being a physical good, tends to appreciate with inflation.

No savings = no investment

It’s not how much money you make, but how much money you keep. How hard it works for you.

Robert Kiyosaki

If you want to be an investor, you must be able to set some money aside on a recurrent basis. You can’t invest if you have no money to invest. In general, the root causes for having no money to invest are are either an insufficient income or improper budgeting.

Insufficient income

If you don’t have a stable income or your income is barely enough to cover basic necessities, then you shouldn’t invest. Focus all your energy in developing and exploiting skills that can increase your income from work. Don’t try to strike it rich by approaching investing as gambling. It won’t work. You’ll end up worse off.

Improper budgeting

If you have a high, stable salary but somehow you still can’t set aside money to invest, your issue is different. You’re likely suffering from lifestyle creep (or lifestyle inflation). In simple terms, you’re flushing all your money because you’re perceiving luxuries as necessities. The only limit to how much money you’re willing to spend per month is, well, your monthly salary. Lifestyle creep has no limits. Even if you increase your salary tenfold, you can always find ways to flush it all. If you suffer lifestyle inflation, you need to work on controlling your expenses and setting a budget for yourself before you’re ready to invest.

All subsequent sections assume that you’re in a financial position that allows investing. Even if it’s just 200 bucks per month.

Time is your friend

The stock market is a device to transfer money from the impatient to the patient.

Warren Buffett

Did you think that investing is all about reading newspapers and placing daily bets on the market based on your judgment? Well, you got it wrong. At least if you want to make money. In fact, I’d be willing to bet that you’d lose money as a day trader. Fees and emotional decisions would cripple any possible returns.

It’s a better idea to approach investing as a long term endeavor. Why? You’d ask. The main reason if the relationship between volatility and time. Volatility is the value swings your investments experience. As an investor, you don’t like volatility. High volatility means you don’t know whether you’re going to make or lose money. It means uncertainty.

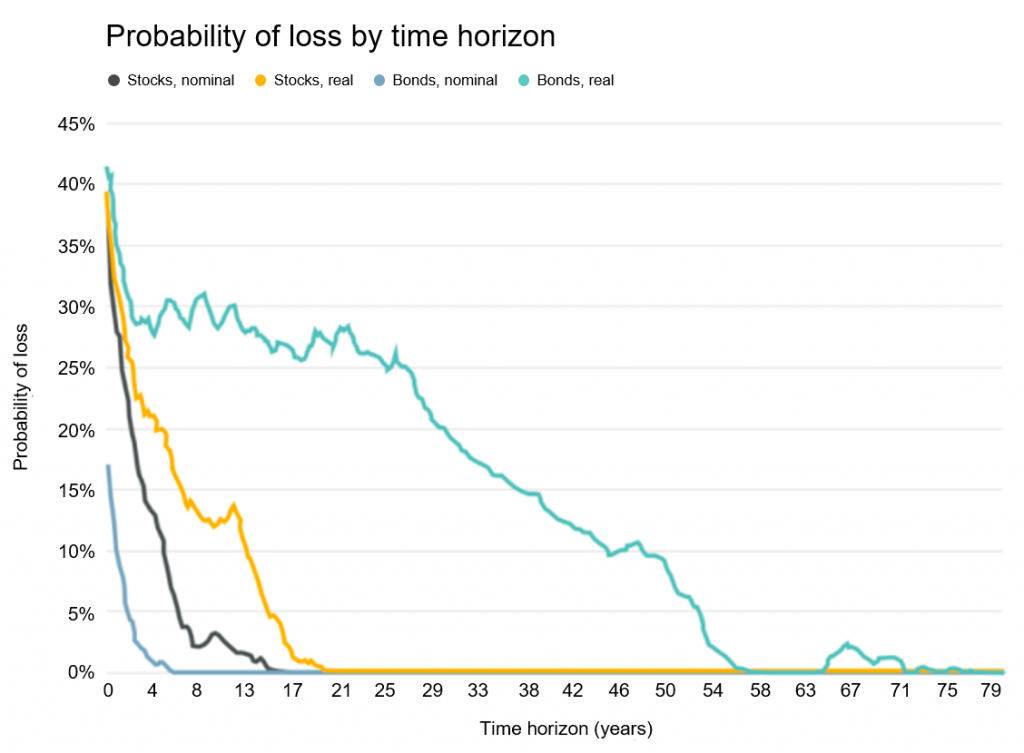

Long term investments tend to exhibit less volatility [2]. I find the chart below quite insightful. It shows how unlikely it is to lose money if you stay invested for long enough. Time kills uncertainty.

The chart differentiates between stocks and bonds. We’ll talk more about their differences later. For each, it also splits between nominal and real. In simple terms, real means ‘inflation adjusted’. When inflation is factored in, its easier to make a loss. This is because inflation always eats away returns. Nominal doesn’t consider inflation. In nominal terms, you’d be happy if you invested 10k in 1990 and have 12k now. In real terms you’re not, because 12k today are worth less than 10k in 1990.

When looking at the chart, you might think that bonds aren’t that great. In real terms you still have 25% chances of loosing money after 20 years. How can this be any good? Well, remember that, for cash, the probability of a real loss is 100%. Just think about the inflation chart we saw before.

The chart above is eye opening. But in case it still doesn’t convince you, here are some additional reasons to stick to long term investing:

- Lower transaction fees, because you buy/sell less often

- Reduced stress, as you don’t have to constantly second-guess whether you got it right

- Lower time commitment, because you go on autopilot and buy the same amount on a recurrent basis

- Potential tax advantages, as not selling will avoid any potential capital gains taxes

Your investment horizon

Invest for the long haul. Don’t get too greedy and don’t get too scared.

Shelby M.C. Davis

We saw that time is our friend. We want to invest long term because it helps eliminate volatility. It other words, long term investing helps make sure that we’ll make money. But how long is long term?

Long term should be aligned with your financial goals. But you need to careful here. You likely have more than one financial goal. For example, you might want to buy a new phone next month. But also buy a house in 10 years. And to retire in 30 years. Only you can prioritize short vs long term. Nobody else can do it for you. However, because investing long term provides the best results, I’d advise to prioritize long term goals when in doubt.

Be careful not to overstate your investment horizon. You don’t want to invest money that you need. You don’t want to ever be in a position in which you have to sell your investments. Suddenly restricting your investment horizon can have disastrous consequences. For example, it might force you to sell during a crash. You don’t want to sell during a crash. Common situations that threaten your investment horizon are loss of income, big purchases and financial risks. Let’s look into them.

Loss of income

Losing your job kills your periodic income. If you run out of cash before finding a new job, you may be forced to sell your investments. As a precaution, it’s wise to hoard 6 months to one year worth of expenses in cash.

Big purchases

Think of buying a house. Say you intend to buy a house in 3 years and need CHF 150k as down payment. If this is the case, then either you have CHF 150k cash to spare or your investment horizon is 3 years. This is a very short investment horizon. As we’ll see later, you shouldn’t invest in stocks or equity ETFs.

Financial risks

Imagine you suddenly require medical treatment worth CHF 40k per year. You might have to sell your investments next year. Your investment horizon is suddenly months. Or imagine that you’re liable for a ski accident and you have to pay CHF 1m in compensation. Your investment horizon is now days. It’s impossible to foresee such risks. But luckily, most can be insured. Health insurance or third-party liability insurance would help with the examples above. Make sure you keep your risks under control.

The longer your investment horizon, the more uncertain it is whether it’ll truly hold. Consider these and other threats when you set your investment horizon. It must be a realistic one. And remember: the longer, the better.

Your risk tolerance

A 10% decline in the market is fairly common. It happens about once a year. Investors who realize this are less likely to sell in a panic, and more likely to remain invested, benefiting from the wealth-building power of stocks.

Christopher Davis

Your risk tolerance is determined by both your capacity to take risks and your willingness to take risks.

Capacity is more of an objective assessment. If you have a stable income, can set aside CHF 1,000 per month (or 500, or 2,000, or 4,000) and have a long investment horizon, then you’re in a solid position to take financial risks. In other words, your risk capacity is high. Does this mean that you’re ready for it? Not necessarily.

Willingness to take risks is way less objective. It has to do with how you feel about taking financial risks. About uncertainty and market volatility. About not having direct control over your wealth.

Imagine that you had 50k invested in equities right now. One week markets go up by 10%, and you make 5k. That’s much more than you can save in a month. Would you feel euphoric? What if markets had gone down and you had lost months worth of savings? Would you be depressed? Would you, in either case, become emotionally attached? Is it possible you’d re-think the way you invest? Would you lose sleep over it? Would you feel concerned after losing 5k in a week?

A high risk tolerance is required for long term investors to be successful. This is the main barrier new investors face. And is often not caused by low capacity, but by low willingness to take risks. A quick test: if the answer to any of the questions above is yes, your willingness to take financial risks may be lower than you think. And hence your risk tolerance. Even if you have high capacity to take financial risks.

The good news is that you can improve your risk tolerance. Both capacity and willingness to take risks will naturally increase over time. Capacity will increase as your salary goes up and you get more in control of your personal finance. Willingness will increase as you learn how to psychologically deal with volatility. It won’t happen overnight. But it’ll feel natural if you start investing early and progressively. First, you’ll have to learn to be unaffected by weekly variations in the hundreds. One day you’ll realize you can take the variations in the thousand. Such as the ‘5k in a week’ scenario we discussed. And it’ll keep going from there.

What you’ve learned so far

We’ve looked into reasons why you should invest. And learned about three key personal aspects to dive into before you start investing:

- Savings capacity: the amount of money you can set aside determines your capacity to invest

- Investment horizon: the longer your horizon, the more risks you can take and the better your expected returns are

- Risk tolerance: capacity and – even more importantly – willingness to take financial risks are prerequisites for you to be a successful investor

Any investment decision you make is dependent upon these three factors. Your first step as a future investor is to reflect on them.

Once your personal circumstances are clear to you, you’ll be ready to move on and explore what’s out there. In the second part of investing 101, we’ll review different asset classes. We’ll also understand the power of diversification. And we’ll see what ETFs are and why they’re a great way to invest. Ready to continue?

Last updated on June 18, 2020

3 replies on “Investing 101 (1/2)”

First, THANK YOU for your time and effort in exploring these topics. I will do my best to make sure others here in CH know about you.

I am a knowledgeable, long term investor (about 30 years so far). I have all of my investments in the US (I am a US citizen, but have lived here in CH for 11 years and plan to stay for the rest of my life). Lately have been worried about the US deficit and the strength of the US dollar in the Dollar/Swiss Franc exchange rate. I am retired and most of my income comes from the US. I’ve been thinking of moving some US assets to CH. I understand the limits of investing in Swiss-based firms with respect to their exposure to FX issues; so I am thinking about a purely Swiss asset class: Swiss real estate. Specifically, one or two apartments from which to derive income. Not looking in particular for asset value growth; mainly income for the rest of our lives (my wife and I). Could you talk a bit about investing in Swiss real estate? You mentioned you would in part 2 of your Investing 101 series, but I hope you don’t mind if I jump ahead a bit. Again, many thanks. So much in your site to think about and use for my own due diligence.

Hi Robert, very happy you enjoyed the content! 🙂 If you worry about FX exposure, the two only options are Swiss bonds and Swiss real estate. Most Swiss bonds have a negative YTM these days, so real estate is virtually the only choice, as you say. Keep in mind that the current availability of cheap credit isn’t good for the yield of real estate investments. In essence cheap credit -> easy mortgages -> more people buying houses -> price of houses goes up -> lower yield when renting out a house.

I do plan to touch on real estate a bit more in the future, but it might take a while :). Thanks for reading!

Like!! Thank you for publishing this awesome article.