The second theme in the tax declaration process has to do with Einkünfte (income). This tax declaration guide covers all possible forms. Most certainly not every form will apply to you, though.

That said, make sure you are exhaustive in indicating all sources of income. Consider both domestic and foreign.

I’d suggest to read Taxes in Switzerland 101 to know more about income taxes in Switzerland. This is not a requirement to continue, though.

Full-time job as an employee

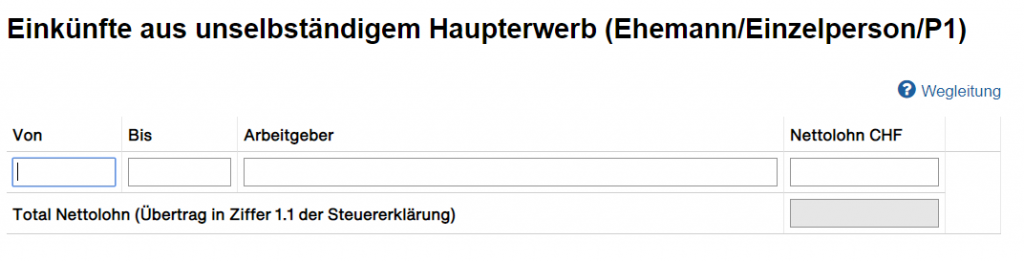

Unselbständiger Erwerb – Haupterwerb

This is one of the most common options. According to the official guidelines, your salary is you all-in compensation. It should include regular salary, bonus, commissions, tips, share programs etc.

Did you have just one employer during the tax year? Then it’s simple. Write von (from) 01.01.20xx bis (to) 31.12.20xx. Did you have multiple employers? Then split according to your payslips.

Nettolohn and the Lohnausweis

The field Nettolohn (net salary) can be confusing. There are some caveats with how net this salary is. Why? Because it’s not really your take-home pay. According to the official guidelines, net salary is gross salary minus:

- AHV/IV contributions (pillar 1 retirement pension and disability insurance)

- ALV contributions (unemployment insurance)

- Pension plan contributions (pillar 2)

- Mandatory accident insurance

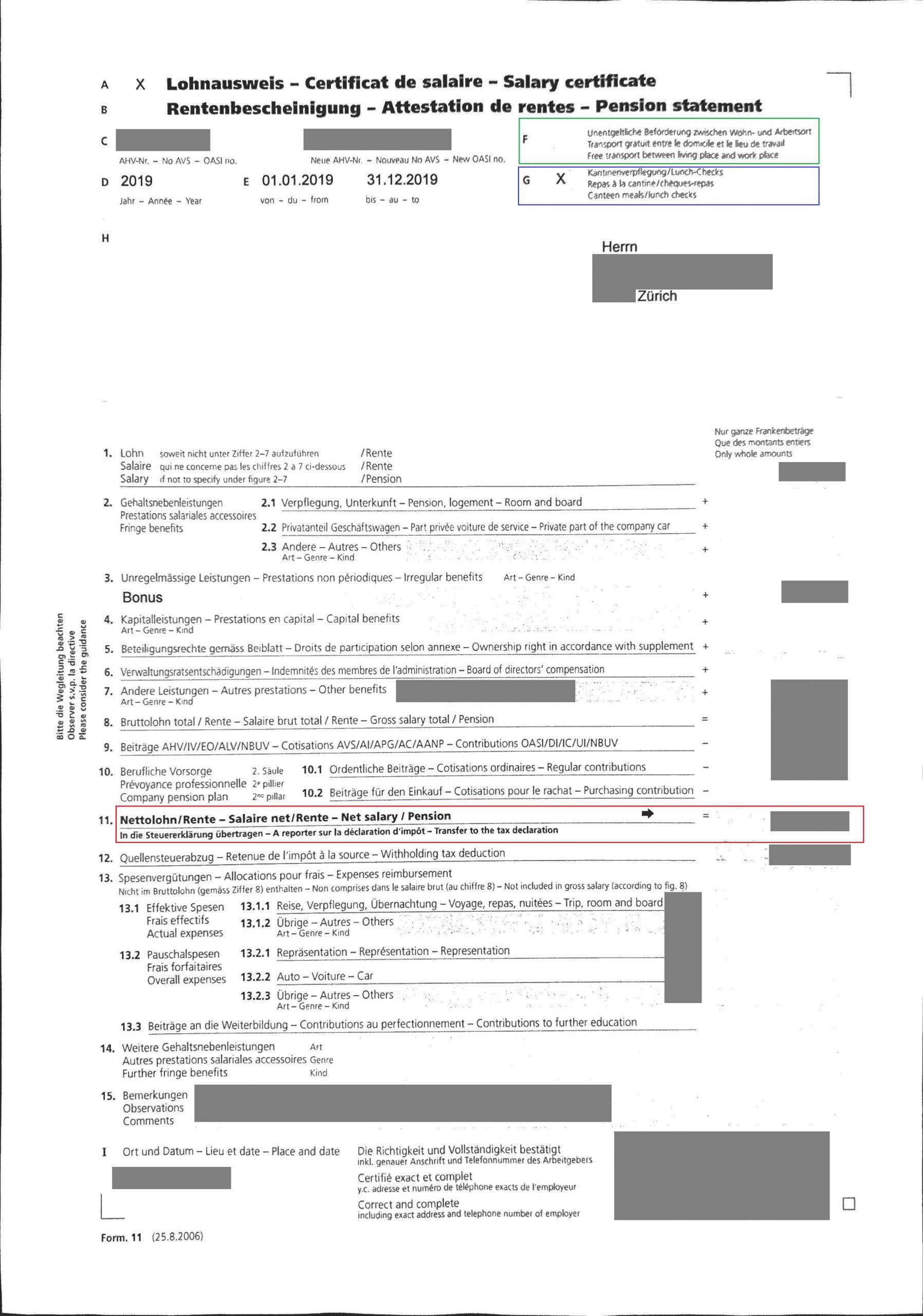

The easiest approach is to transfer the figure from the Lohnausweis (salary certificate). You should receive a Lohnausweis from your employer yearly. Sometimes it comes in late January or early February. Don’t file taxes until you have it. It’s compulsory to attach this document to your tax declaration. So you’ll have to find it anyways.

For reference, this is a sanitized version of a Lohnausweis. The red box highlights the figure you should use.

If you didn’t get a Lohnausweis, ask your company to provide it. HR or payroll people will know.

You don’t calculate your net salary (for tax purposes) yourself. Instead, you get it from the Lohnausweis. If you don’t have one, your ask your company to provide it.

Understanding the Nettolohn

It’s good for your financial literacy to understand how to calculate the Nettolohn. Let’s review a quick example. We’ll start from a payslip:

| Gross salary (Bruttolohn) | CHF 10,000 |

|---|---|

| AHV contribution | CHF 500 |

| ALV contribution | CHF 100 |

| Pension fund contribution | CHF 300 |

| Withholding tax (Quellensteuer) | CHF 1,100 |

| Canteen | CHF 200 |

| Share participation plan | CHF 600 |

| Net salary (Nettolohn) | CHF 7,200 |

For tax purposes, Nettolohn is not CHF 7,200. Why not? Because we’d be deducting more than we should. We are not allowed to deduct the withholding tax. Or the canteen. Or the share participation plan. The figure we should use is 10,000 – 500 – 100 – 300 = CHF 9,100.

What about withholding taxes?

It’s likely that you’re taxed at source and you have to file taxes. This is the status quo if you income is over CHF 120k/year. It’s described here.

If this applies to you, you might be surprised that the Nettolohn doesn’t deduct withholding taxes. This can be confusing. Why would you pay taxes on salary that is already being taxed? Don’t worry. The process is fair. The tax authorities will compare:

- How much you’ve paid already (withholding tax)

- How much you should pay (output of filing your taxes)

They will then debit/credit you the difference.

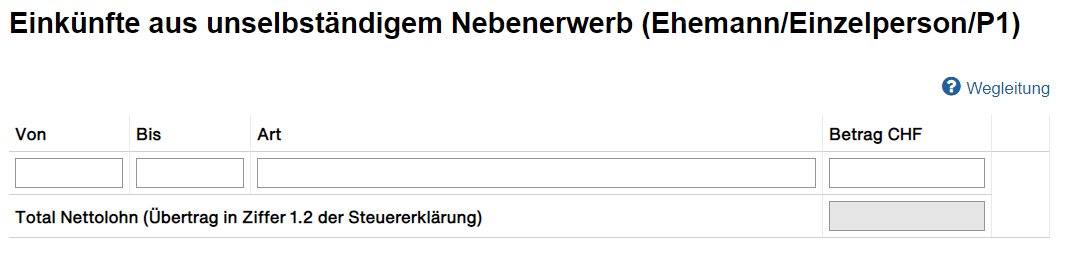

Part-time (or side) job as an employee

Unselbständiger Erwerb – Nebenerwerb

The tax rules for a part-time job are quite different from full-time employment. In the Betrag (amount) field, we’re supposed to take into account gross income received. But not all income. There’s no need to consider income that has been already taxed at source. In other words, no need to declare if you paid withholding taxes. If that’s the case, you’ll have to upload the corresponding AHV certificate to the tax declaration.

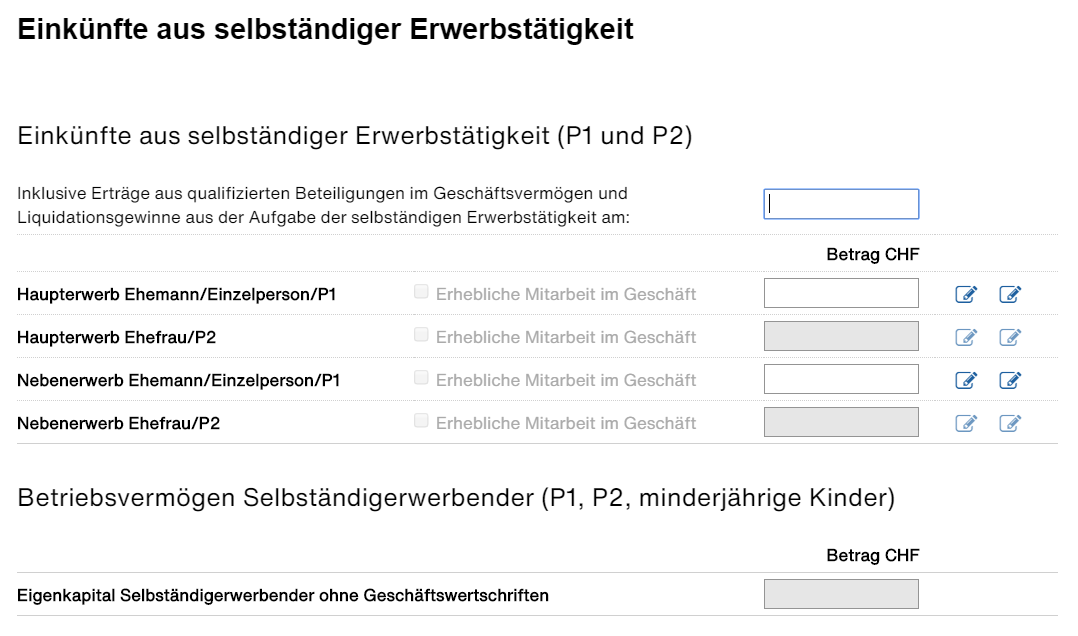

Full- or part-time self-employment

Selbständiger Erwerb

This form is the same for all types of self-employment. Doesn’t matter if it’s full- or part-time. It’s also one of the most tedious forms. A comprehensive detailed assessment is beyond my knowledge. And also beyond what I intend this guide to be. If you’re not qualified already to complete this form by yourself, you’ll likely need an accountant to help you. Nevertheless, I’ll share my high-level understanding:

- Generally speaking, you can deduct more expenses as a self-employed than as an employee. Even more so if you’re in the real estate market. This brings down your taxable income

- Be ready to face a certain degree of double taxation. Your company will have to pay corporate taxes on net profits. Then, you’ll have to pay personal income taxes on your salary/dividends. If you choose not to give yourself a salary but to reinvest in the business, you may still pay capital gains taxes

- Income from appreciating securities or real estate is self-employment income. It’ll be taxed as capital gains. Unless you meet the conditions explained here

- By law, you must keep records of your self-employment activities for 10 years

- If you’re self employed, you declare your income using Hilfsblatt A (auxiliary sheet A). Unless your business is a farm. In this case, use sheet B or G

- There’s five sub-forms in Hilfsblatt A. (1) Basic info about your company. (2) Income and net profit. (3) Inventory. (4) Depreciation. (5) Balance sheet (assets, liabilities, equity)

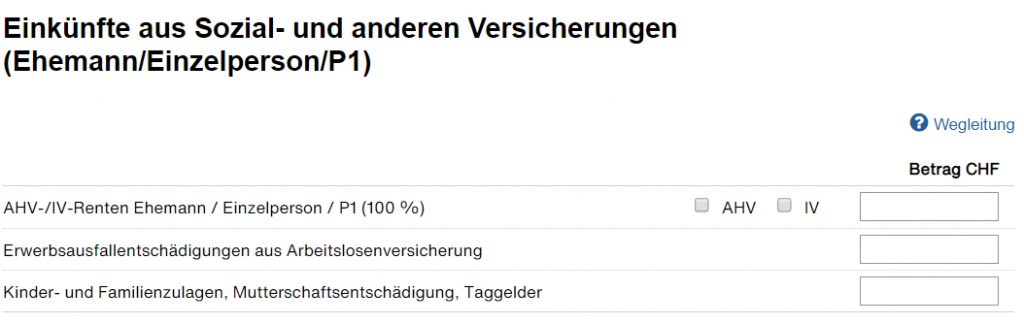

AHV/IV (Swiss social security), loss-of-income insurance and allowances

Sozial- und andere Versicherungen

The form will appear if you selected any of the three following sources of income:

- Renteneinkünften der AHV/IV

AHV/IV (Swiss social security) - Erwerbsausfallentschädigungen aus Arbeitslosenversicherung

Loss-of-income insurance - Kinder- und Familienzulagen, Mutterschaftentschädigung, Taggeldern

Allowances (e.g. maternity, daily allowances etc.)

Any income from AHV/IV is 100% taxable and should be included in the first box.

Similarly, you have to declare any compensation you got as loss-of-income or loss-of-earnings insurance. You’ll be required to attach proof.

In the third and final box you have to aggregate all sorts of allowances provided by your employer and not explicitly captured in your payslips. Examples are contribution to health, disability or accident insurance, maternity allowance, daily allowances, etc. In my experience, these contributions are typically listed in your payslip. So you have to do nothing. It’s worth to double-check, though.

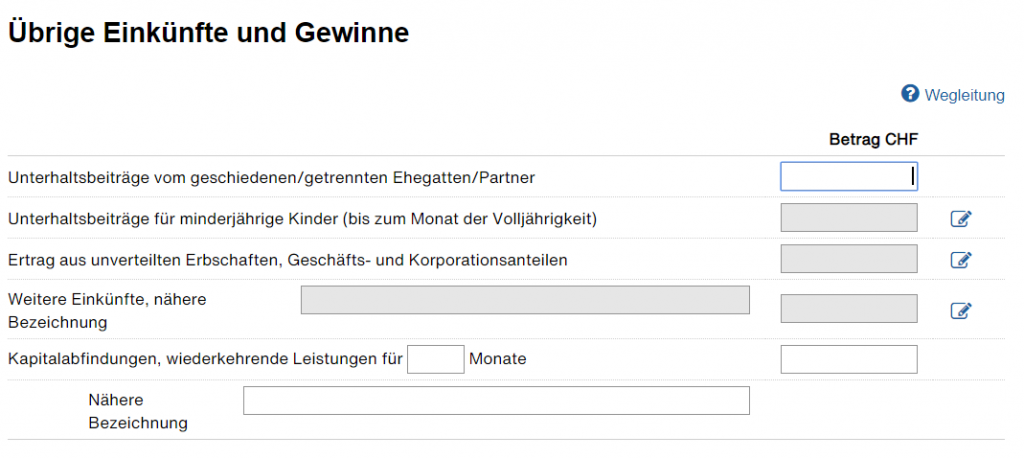

Other sources (e.g. alimonies, employee shares etc.)

Übrige Einkünfte und Gewinne

Any sort of alimony received from a separated spouse must be declared in the first box.

Similarly, alimonies received for minors should be indicated in the second box.

The third box captures income from undistributed inheritances and company shares.

The fourth and final box is a hodgepodge. You can write here any additional income that doesn’t fit anywhere else.

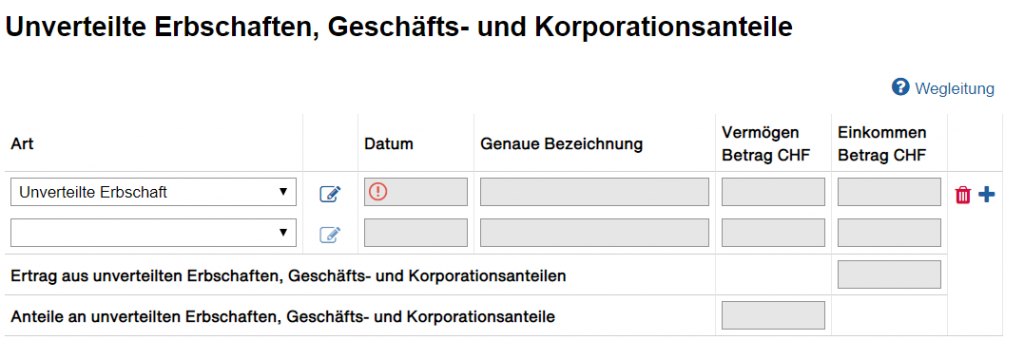

Undistributed inheritances and company shares

Unverteilte Erbschaften, Geschäfts- und Korporationsanteile

If you got any income from undistributed inheritances or corporate shares, just fill it in either form. Both seem to be linked.

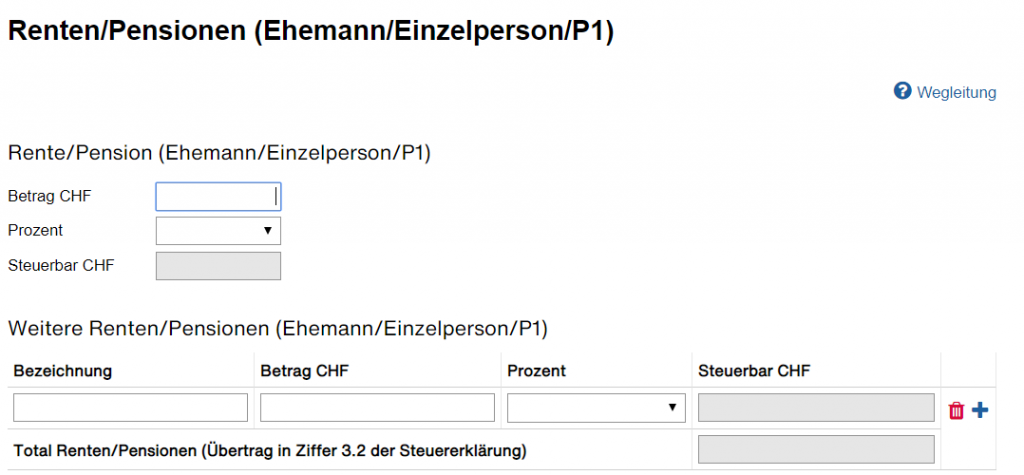

Pension fund

Renten/Pensionen

Income from pensions is taxable income. The tax rate (the Prozent) ranges from 40% to 100%. You can find a comprehensive list of possible cases in the tax declaration guidelines. It’s page 13 of the guide 2019. It reads Einkünfte aus Sozial- und anderen Versicherungen, Leibrenten [Ziffer 3].

Final note

Notice that we didn’t have to declare any income from real estate (e.g. rent) or financial assets (e.g. interests/dividends). Why? Because we’ll declare such income in subsequent themes.

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 13, 2021

3 replies on “Tax declaration guide (2/6): Einkünfte”

Hello, what are income from company shares and how are they different from financial assets income (dividends).

Unverteilten Korporationsanteilen are undistributed company shares. I’d venture to say dividends belong in 99% of the cases to either the list of securities or the DA-1 form. Only consider that box if you have any sort of special arrangement to receive shares (stock owner at private company, exotic stock compensation schema, inheritances etc.)

Do other income sources such as Sozialhilfe (and/or Basisbeschäftigung) need to be declared? If so,do they need to be added in this section, maybe in “Weitere Einkünfte”?