The first theme in the tax filing process deals with first generic personal data (Persönliches). It then covers some very specific fields that have to do with inheritances, presents etc. We’ll cover all forms as part of the tax declaration guide.

Taxable individuals

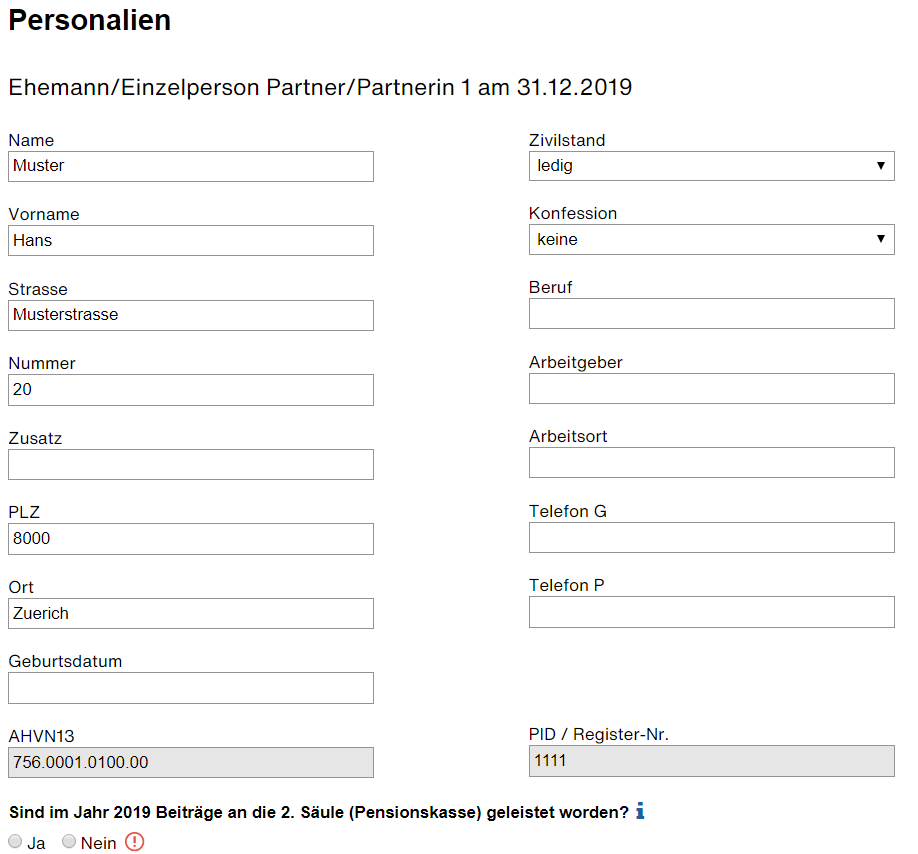

Steuerpflichtige Personen

This form is quite straightforward. Besides personal data, the only field worth mentioning is the one about the pillar 2 contributions. This is the sentence at the end that reads Sind im Jahr 2019 Beiträge an die 2. Säule (Pensionskasse) geleistet worden? If any of your payslips during the year has deduction for pillar 2 (pension fund) the answer is yes. If you contributed directly to it, the answer is yes as well.

Children

Kinder

If you have kids, you can deduct both childcare and children maintenance contributions.

Childcare costs (Fremdbetreuungskosten) are deductible up to CHF 10,100. A daycare center qualifies. This is only claimable until the minor’s 14th birthday, and assumes that childcare is required due to employment, training, or disability. In addition, you’ll have to attach proof of payment.

Children maintenance contributions (Unterhalt / Sorgerecht) could be payments you make to a spouse. The official guidelines distinguish whether you:

- Live with you spouse or are widowed

- Live alone with your children

- Don’t live with your children

- Live with your children and your partner, but are not married

There are more sub-cases depending on whether you receive child support. Or depending on whether one/both parents have parental responsibility. In general, all cases are clear enough in the official guidelines. You can find them on p.24 in the 2019 version.

Regardless of the case, there’s a different deduction for cantonal and federal income. The cantonal deduction is in the range of CHF 4.5-9k in canton Zurich. The federal deduction is in the range of CHF 3.2-6.5k. If a form allows to differentiate, then do.

Dependents

Unterstützte Personen

You should also indicate if you have any dependents under Unterstützte Personen. Dependents are those in need of financial aid you support. They can be minors or adults. They must be (partially) unable to work due to physical or mental reasons. You’ll have to indicate the details of the dependent, the support provided and (possibly) proof of payment. Notice that there’s a threshold to claim this deduction. The cantonal deduction required a minimum a payment of CHF 2.7k. This goes up to CHF 6.5k for the federal deduction.

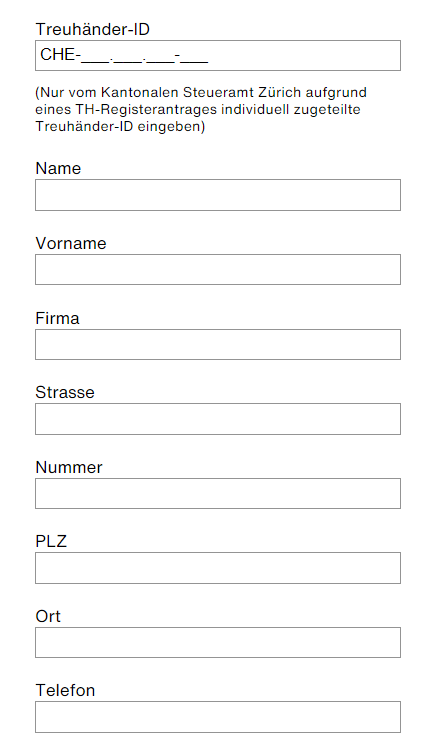

Tax representative

Vertreter

You can leave this blank if you’re doing the tax declaration on your own. Which at this point I assume.

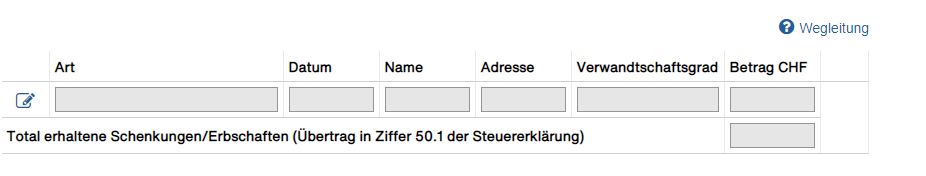

Inheritances or donations received

Erhaltene Schenkungen / Erbschaften

List here all donations and inheritances received. The sub-form is easy enough to navigate.

The guidelines mention that declaring gifts is a separate process from the regular tax declaration. You must declare gifts within three months of reception. Gifts from spouses, partners, descendants and other occasional under CHF 5,000 are exempt. Hopefully one of the exemptions applies to you. If it doesn’t, you have to follow the guidelines detailed here.

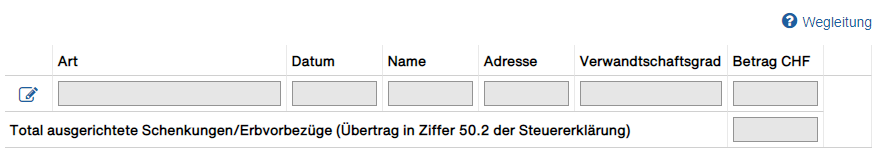

Arranged inheritance advancements

Ausgerichtete Schenkungen / Erbvorbezüge

This form is similar to the previous. The difference is that previous dealt with inheritances already received. This one deals deals with newly arranged inheritance advancements.

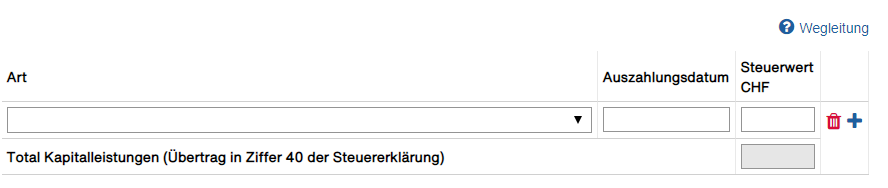

Capital benefits

Kapitalleistungen

Declare here capital benefits (Kapitalleistungen) from vesting pension plans. These are typically pillar 2, pillar 3a, disability insurance etc.

In general, capital benefits are 100% taxable. They are tax separate from income at a lower rate, though. Exempt are lump-sum benefits from pillar 2. This is regardless of it being final or temporary (e.g. when you change employers). In the latter case, the time window for the change is one year.

Let’s go through all fields in the form:

- Aus AHV/IV

Payments from Swiss social security (Alters- und Hinterlassenenversicherung). Or from mandatory invalidity insurance (Invalidenversicherung) - Aus Freizügigkeitskonto/-police

Any kind of vested benefits from pension plans - Infolge Tod oder für bleibende körperliche oder gesundheitliche Nachteile

As a result of death (e.g. life insurances) or disabilities - Aus einer Einrichtung der beruflichen Vorsorge (2. Säule)

From an occupational pension scheme such as pillar 2 - Aus einer anerkannten Form der geb. Selbstvorsorge (3. Säule a)

From pillar 3a - Sonstige

Any others

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 13, 2021

2 replies on “Tax declaration guide (1/6): Persönliches”

what about capital benefits from an investments account

AFAIK these are “Kapitalleistungen”, mentioned in this very post and also in the section “Withdrawal taxes for pillar 3a” of this post