Ever wondered how taxes in Switzerland work? What kind of taxes are there? Who do you pay taxes to? And how to do you pay them? How much taxes do you you pay for a given income and wealth? This entry will help you answer all those questions.

About this entry…

This is an introductory entry on how taxation works in Switzerland. You don’t really need to know the whole theory behind Swiss taxation in order to file your tax declaration. If that’s your only goal, you can start right away here. That said, having some basic knowledge of the taxation framework of the country you live in can’t be a bad idea.

The title of this entry quite broadly refers to Swiss taxation. However, all examples in this article will focus on canton Zurich municipality of Zurich. Let’s get to it.

What you pay taxes on

If you’re a Swiss resident, you must pay taxes on your worldwide income and wealth. This means that sources of income in other countries are subject to income tax. Similarly, wealth/assets held outside of Switzerland are also subject to wealth tax.

If you’re not a tax resident in Switzerland, you only have to pay taxes (to Switzerland) on income from Swiss sources and on wealth held in Switzerland [1].

Who you pay taxes to

As a Swiss resident, you pay taxes at three different levels [2]:

| Level | In German | Description | Income tax | Wealth tax |

|---|---|---|---|---|

| Federal taxes | Bundessteuer | Paid to the Swiss Confederation | ✓ | ✗ |

| Cantonal taxes | Kantonssteuer | Paid to cantons, who are free to decide on their own tax rates | ✓ | ✓ |

| Municipal taxes | Gemeindesteuer | Paid to the Gemainde, which also sets its own tax rate | ✓ | ✓ |

Notice that all Confederation, canton and municipality levy income taxes. The Confederation, however, does not levy tax on wealth. Municipal taxes also include taxes to church, which depend on the confession (if any). But more on that later.

As a Swiss resident you also pay a Value Added Tax (VAT) on any product or service you purchase. The Swiss VAT standard rate is 7.7%. This rate is by far the lowest in Europe. The second lowest seems to be 17% in Luxembourg [3]. You pay VAT automatically whenever you buy anything. It’s part of the bill. Because there’s nothing to be done with the VAT, the rest of the article focuses on income and wealth taxes.

How you pay taxes

There are two ways how Swiss residents pay taxes to the government:

- Taxes at source (withholding tax)

- Regular tax declaration (tax filing)

Taxes at source or withholding taxes (Quellensteuer) are taxes that employers automatically retain from salaries and pay to the government [4]. If you withhold taxes, full pre-tax income doesn’t even hit your bank account. All you get with your monthly payslip is a post-tax figure. The government is already banking the difference. This is not that bad. Withholding tax simplifies things. It makes it possible for you to forget about taxes altogether. You don’t have to file taxes.

How are withholding taxes calculated? They are based on standardized tax rates. These rates depend on income, marital status, confession and number of children. You can find the withholding tax rates for canton Zurich here. Withholding tax rates account for a set of assumptions/deductions that the Swiss tax authorities consider fair for an average citizen.

With the regular tax declaration system, you do get your full pre-tax income in your bank account. Once per year, you pull together your yearly income, expenses, assets etc. to calculate the taxes you owe to the Swiss government. Needless to say, it’s good practice to set cash aside during the year to account for the accrued taxes you owe.

When you have to file taxes

Swiss nationals always have to file their taxes. If you’re not Swiss, you’ll be taxed at source, unless [5, 6]:

- You have a C permit

- Your income exceeds CHF 120k/year (applicable to most cantons, but Geneva: CHF 500k/year)

- Your assets exceed CHF 200k (applicable to canton Zurich)

- Your non-taxed at source income (e.g. dividends) exceeds CHF 2.5k/year (applicable to canton Zurich)

If your income is above the threshold, the tax authorities will send you a letter informing that you have to declare taxes. This is referred to as Nachträgliche ordentliche Veranlagung. No proactivity is required from your side.

If you hit the income threshold, you’ll have to file taxes while you’re taxed at source. At least until you get a C permit. The difference between the regular tax declaration (what you have to pay) and the withholding tax paid during the period (what you paid) will be debited/credited to you.

You should be proactive if you meet any of the other conditions. At least to my understanding. The tax authorities can find out systematically about your Swiss income. But I don’t think they can find out about your assets. Especially considering that you might have assets abroad. The same applies for non-taxed at source income. If either applies to you, my advice is to contact the tax office.

You may also voluntarily go through part of the tax declaration process. For example, you may want to recover withholding tax held by Swiss brokers on income from US securities (more info here). Or you may want to benefit from pillar 3a deductions.

The rest of this entry focuses on income and wealth taxes paid via the regular tax declaration system.

Income tax

Income tax consists of taxes on your income or profits. Typical examples are salary, dividends, interests, rents etc. Income taxes in Switzerland are levied by:

- The Swiss Confederation (Bundessteuer)

- The canton (Kantonssteuer)

- The municipality (Gemeindesteuer)

We’ll cover each of them separately. Then, we’ll bring them all together to get a holistic picture of income taxes in Switzerland.

Bundessteuer

Federal taxes or Bundessteuer are paid directly to the Swiss Confederation. Federal tax brackets are conveniently available in the Staatssteuertarife for canton Zurich. This doc also contains the Kantonssteuer, but more on that later.

Bundessteuer are different depending on marital status. This means that the tax rates are difference for single individuals and married couples. If you’re married, you and your spouse will have to submit a single tax declaration. And will use the married rates. Generally speaking, you pay more taxes once you marry (more on this later).

The two charts below show the average and the marginal federal income tax rate. As a quick refresher, the average tax rate is the total amount of tax divided by total income. The marginal tax rate is the incremental tax paid on incremental income. The marginal tax rate is always higher than the average tax rate in an incremental tax bracket system. This is the case in Switzerland, like in most other countries. If you’re not familiar with these concepts, you should check this entry (which includes examples) before continuing.

As a final note, federal income taxes are reduced by CHF 251 for each child or dependents living in your household. The charts above do not consider any reduction.

Kantonssteuer

Cantonal taxes or Kantonssteuer are set independently by the different Swiss cantons. Here I’ll focus on canton Zurich. Cantonal tax rates for canton Zurich are available in the Staatssteuertarife. As a curiosity, these rates have been unchanged since 2003.

Gemeindesteuer

Contrary to federal and cantonal taxes, municipal taxes aren’t found on tables. Instead, they are the result of applying a multiplier to cantonal taxes. This multiplier depends on municipality and religious confession (Gemeinde- und Kirchensteuerfüsse). For canton Zurich, you can find the multiplier here.

Notice how widely this multiplier varies. In canton Zurich – and assuming no church tax – the multiplier ranges from 0.72x to 1.3x for different municipalities. The municipality of Zurich sits at 1.19x (again, assuming no church). This means that the effective total tax for cantonal plus municipal taxes in Zurich is 2.29 * cantonal taxes.

Religious confession also influences the tax multiplier. For the municipality of Zurich [7]:

| Confession | Tax multiplier |

|---|---|

| None | 1.19x |

| Reformed church | 1.29x |

| Catholic church | 1.29x |

| Christian Catholic church | 1.33x |

I won’t bother showing the charts with marginal and average tax rate in this case. Both lines would simply be an scaled up/down version of cantonal taxes. Besides, there are now 600+ possible permutations depending on your municipality (153 different ones in canton Zurich alone) and confession (4 possible choices).

Bringing it all together

The following charts bring together the three tax levels*. The first applies to singles. The second to married couples:

See on the charts that, although similar, total income tax differs for single individuals and married couples. Let’s focus on three data points:

| Total income (CHF) | Total income tax, single (CHF, (%)) | Total income tax, married (CHF, (%)) |

|---|---|---|

| 100,000 | 16,662 (16.7%) | 12,668 (12.7%) |

| 200,000 | 50,741 (25.4%) | 43,143 (21.6%) |

| 400,000 | 132,879 (33.2%) | 120,310 (30.1%) |

Notice the effect of marital status on income taxes. If both spouses earn a similar income, being married makes you pay more taxes. For example, let’s look at the case of two individuals, each earning CHF 100k.

- If they’re single, they file taxes independently. Each will pay CHF 16,662 in income taxes. Total income tax is CHF ~33k

- If they’re married, they file taxes together. Total income tax is CHF ~43k

Marriage increases income taxes by CHF 10k! That’s an additional ~5% income tax rate for each spouse.

If there is a large income disparity, however, the married tariff can decrease the income tax burden. In the extreme case of one spouse earning CHF 200k and the other not having income at all, income taxes would go down by CHF ~7.5k with the married tariff.

*In reality, the taxable income for the Bundessteuer is often slightly different than for the Kantonssteuer. This is because Federal government and cantons treat tax deductions differently. A typical cause for the discrepancies is the deduction of health insurance premiums. Because of this, the charts above bringing all taxation levels together are not 100% accurate. They are still a very close approximation.

Wealth tax

Wealth tax is a tax levied on the market value of the assets you hold. These assets include cash, shares, fixed income securities, real estate, personal cars, money funds etc.

In a nutshell, income tax took a slice of money you earn. Wealth tax takes a slice of things you own.

No wealth tax is paid directly to the Swiss Confederation. But we still pay wealth taxes to:

- The canton (Kantonssteuer)

- The municipality (Gemeindesteuer)

Kantonssteuer

Similar to income tax, wealth tax at a cantonal level can be found in the Staatssteuertarife. Broadly speaking, wealth taxes in Switzerland are quite low. The marginal tax rate on wealth tops at 0.3% when you reach CHF ~3.2m in assets. In addition – and unlike income taxes – there is little difference between the single and the married rates:

Gemeindesteuer

Municipal and church taxes are calculated exactly the same way as in the case of income tax. They are the result of applying a multiplier to cantonal taxes. The multiplier is the same one we used for income taxes. This means that it still depends on municipality and religious confession. Remember that for the municipality of Zurich, no church, the multiplier is 1.19x. Marginal and average tax rates on wealth are once again a scaled up/down version of cantonal taxes.

Bringing it all together

We can aggregate the wealth tax levied by the canton and the municipality to come up with the total wealth tax. Marital status has a negligible effect this time, so we’ll only focus on the tariff for singles:

Notice how low wealth taxes are in canton Zurich. This generalizes well to other cantons, with some variations. I find these three data points quite illustrative:

| Wealth (CHF) | Total wealth tax (CHF, (%)) |

|---|---|

| 200,000 | 135 (0.07%) |

| 1,000,000 | 2,103 (0.21%) |

| 2,000,000 | 6,144 (0.31%) |

Calculate your taxes

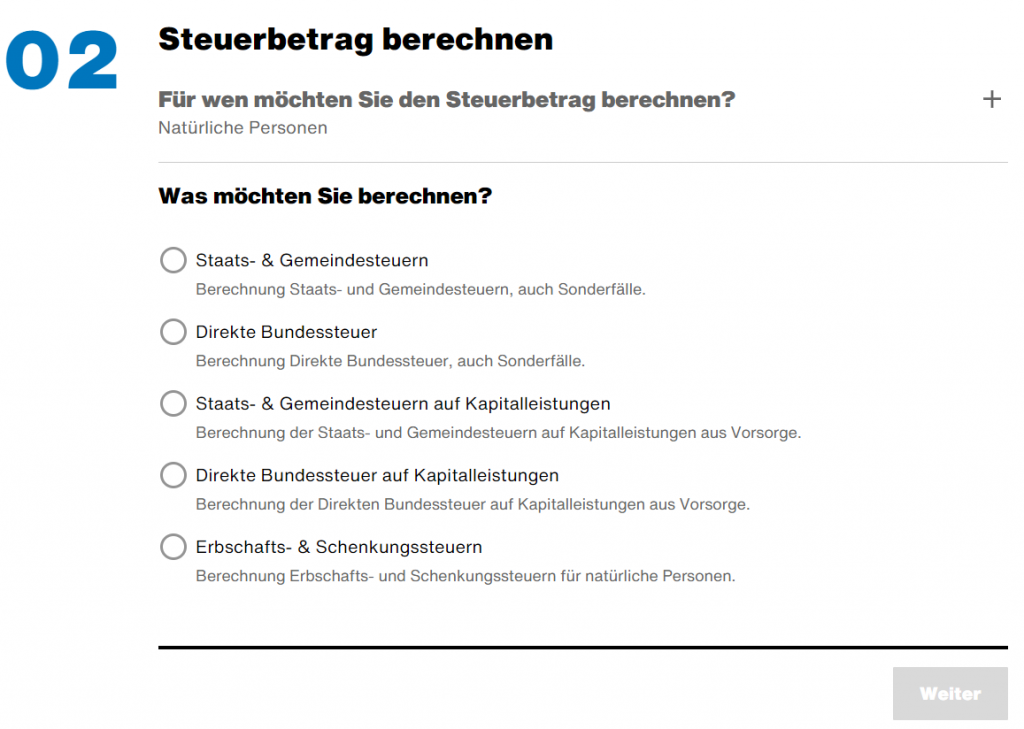

If you live in canton Zurich and are curious how much taxes you have to pay, you can use the tax calculator from the Steueramt Zurich. After clicking on Steuerrechner, you can estimate total federal, cantonal and municipal taxes. Both for income and wealth tax. After reading this entry, you should be able to make sense of every output number.

What you’ve learned

That’s it! This was a dense entry, but if you made it here you should now have an understanding of:

- Who you pay taxes to as a Swiss resident

- Different systems to pay taxes (withholding vs tax declaration)

- Types of taxation (income vs wealth)

- How high taxes are in Zurich/Switzerland

- Different variables affect your tax rate (e.g. marital status, confession)

If want to know more, you should check other posts in the tax category. Particularly important for many, taxes on pillar 3a investments are covered here. Good luck!

Last updated on March 14, 2021