Are you looking to invest in pillar 3a? There are dozens of alternatives out there. Which is one is better? And is any of them better than just investing the money yourself in a low cost ETF? This entry introduces an app to enable an easy comparison of different pillar 3a alternatives.

Are you familiar with how pillar 3a works?

This entry focuses on comparing pillar 3a alternatives. It assumes you’re familiar with how pillar 3a works. Do you know all tax advantages pillar 3a offers? Why your marginal income tax rate is so important when deciding whether to invest in pillar 3a? Or why having multiple pillar 3a accounts is better? If you don’t, check this post before you continue reading.

An app to compare pillar 3a alternatives

In essence, pillar 3a offers tax savings at the expense of higher fees. Which effect dominates?

I built an app to help answer exactly that question for different sets of assumptions. It also facilitates the comparison of different pillar 3a alternatives. You can access the app here.

Note: if the link doesn’t work for you, try using Microsoft Edge or using this mirror.

The app should be intuitive enough to use straight away. However, I encourage you to keep reading. You’ll find out more about the different model inputs, the modeling approach, and some interesting general insights.

How to analyze and compare pillar 3a alternatives

The app tries to help you answer an important question. Is pillar 3a is right for you? In the end, it all comes down to expected returns. And what do pillar 3a returns depend on? Generally, on three aspects:

- Your personal situation

- The return assumptions you make

- What pillar 3a providers have to offer

Each of these aspects is a group of assumptions in the app (left sidebar). Let’s review each.

1. Your personal situation

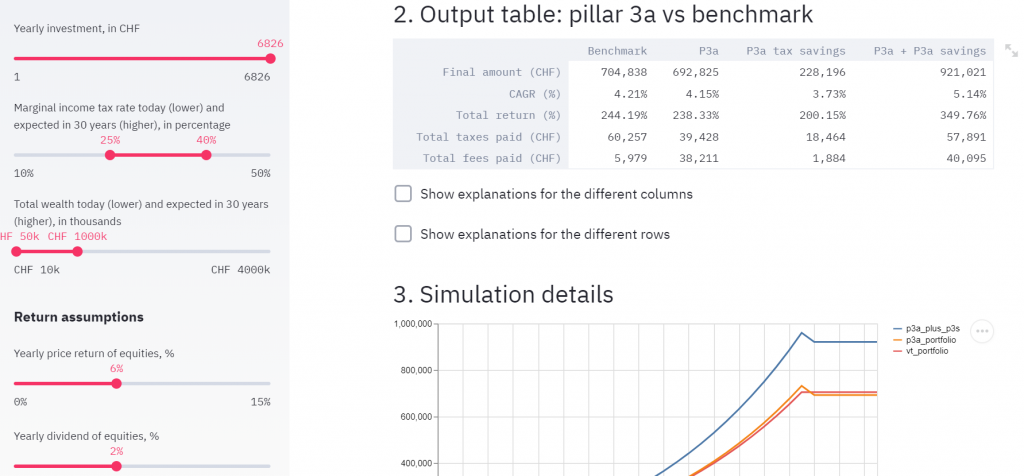

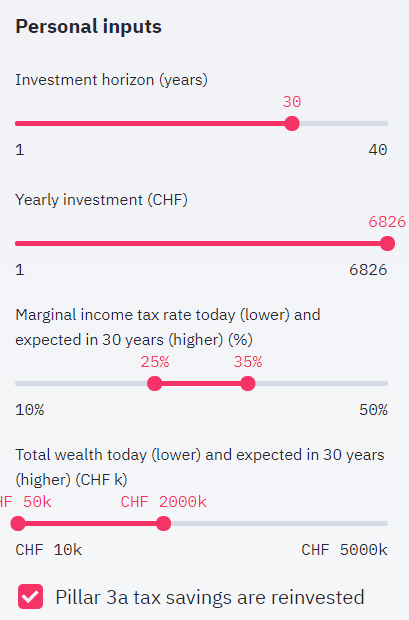

There are several variables determined by your personal situation that affect the returns of pillar 3a investments. These personal inputs are:

- Investment horizon. Years until you cash out. As explained here, short investment horizons are very lucrative with pillar 3a. But it’s not a scalable strategy. Long term horizons are more common

Default: 30 years - Yearly investment. Money you set aside each year to invest. This obviously doesn’t affect your return rate, but your totals

Default: CHF 6,826, current max for those with a pillar 2 - Marginal income tax rate. We saw that a high marginal income tax rate is crucial for pillar 3a to make sense. This rate typically goes up with time as you increase your income. The app allows to input two rates: one today and one at the end of the investment horizon. It interpolates between the two for each year in between. Check this entry if you don’t know your marginal income tax rate

Default: 25% today, 35% at the end of the investment horizon - Total wealth. We also saw that you don’t pay wealth tax on your pillar 3a portfolio. The impact of these savings depends on your wealth tax rate. This one will be estimated automatically for you based on your wealth. Like before, you can differentiate between wealth today and wealth in the future

Default: 50k today, 2m at the end of the investment horizon - Pillar 3a tax savings are reinvested. This box is an important one. What will you do with the tax savings from pillar 3a? Will you use them to buy stuff or will you invest them? This has important implications for long term returns. We’ll touch on this again later

Default: True

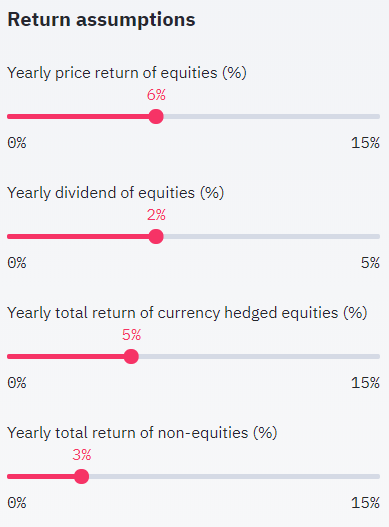

2. Return assumptions

Needless to say, return assumptions greatly affect outputs. The different return variables you can control are:

- Yearly price return of equities. Quite self explanatory. Price return and dividend return are separated to account for dividend taxation

Default value: 6% - Yearly dividend of equities. Also self explanatory. Remember that this plus the price return makes the total return for equities

Default: 2% - Yearly total return of currency hedged equities. This one is a bit more complex. You’ll have to read this to understand why currency hedged solutions have lower returns. At the time of writing, the cost of USD -> CHF hedging is ~3%. Hence the difference in the default values for returns. This field is important because many pillar 3a providers offer hedged investments you can’t get rid of

Default value: 5%, 3 p.p. lower than the total return for non hedged equities - Yearly total return of non-equities. This is a hodgepodge to capture the total return of everything that isn’t equities. Everything includes cash, bonds, real estate etc. Potentially in variable shares. I decided aggregate it all to keep the model simple. Hopefully most of your pillar 3a portfolio are equities anyways

Default value: 3%, which is quite generous

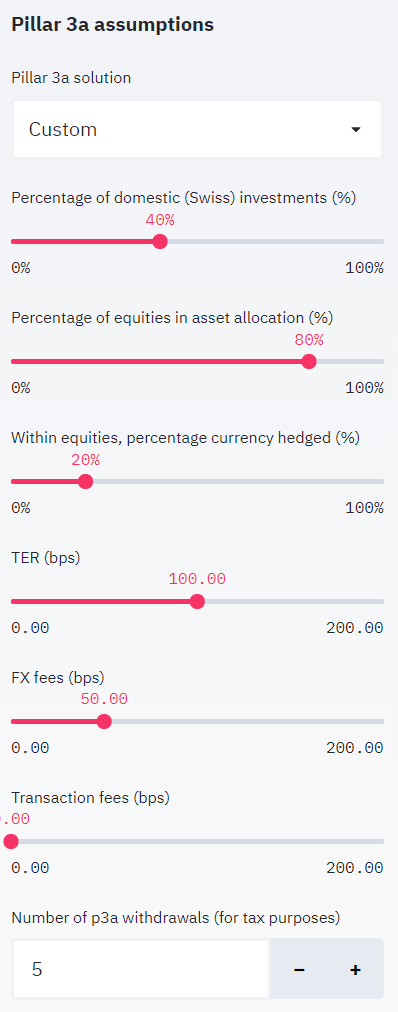

3. Pillar 3a offers

The pillar 3a solution also affects returns greatly. The app features some pre-loaded solutions. We’ll cover those later. For now, let’s focus on the different variables of a custom solution:

- Percentage domestic investments (Swiss). The impact of this input is very minor. It’s not used to set different return assumptions for Swiss vs non-Swiss investments. The model doesn’t allow for that. Instead, it’s simply used to estimate stamp duties correctly

- Percentage of equities in asset allocation. Self explanatory. This affects the total return of the portfolio based on the return assumptions

- Within equities, percentage currency hedged. Idem

- TER. Total Expense Ratio of the pillar 3a solution. Remember that beeps (or bps) are 1/100 of a percentage point

- FX fees. Fraction of investments paid as currency exchange fees. Either explicit or implicit (e.g. worse than market rate)

- Transaction fees. Fraction of investments paid as fees to transact

Now coming back to the pre-loaded solutions. You can check the assumptions for each easily. Simply hit the check box “Show underlying pillar 3a account assumptions” on the app.

Finally, the “number of p3a withdrawals” is used to calculate the withdrawal tax rate. This is the tax you pay when you cash out your pillar 3a portfolio. As you know from here, the more pillar 3a accounts – and hence separate withdrawals – the better.

The benchmark

We said earlier that the decision to invest in pillar 3a depends on the expected return. That’s actually only half the truth. The other half is how those returns compare to other alternatives. We need a benchmark.

What’s a good benchmark? Well, true to the long investment horizon, low cost mantra of this website, a low cost equity ETF seems like a good choice. We’ll use as benchmark a 100% allocation to Vanguard’s world equity fund (VT). You can find more info about this found in this entry.

The best pillar 3a provider

Time to analyze some results. What’s the best pillar 3a provider? Well, it depends on the set of assumptions you input. However, with common sense assumptions, there is a clear winner: VIAC 100. Here’s some reasoning:

- The fees of VIAC sit at 0.51%, which is ‘OK’. At least for pillar 3a standards. PostFinance’s 1% is a no-go

- Frankly has similar fees to VIAC, but currency hedges too much. At present this has a big toll on returns

- Within VIAC, the more equities the better. At least if we believe the default return assumptions. Hence the 100 strategy

Note that there are new pillar 3a providers and solutions coming to the market every year. This conclusion might change at any time. It’s actually an upside of pillar 3a that fees might continue to decrease as new players enter the market. This is at least the trend over the past ~5 years.

Disclaimer: I’m not related to VIAC in any way nor I receive any benefit from them. I actually don’t even have an account with them (yet)

Do you know other solutions that might compete well? Comment below or send me an email and I’ll try to add them as pre-loaded solutions!

When pillar 3a makes sense

Alright, so it seems like VIAC is a good choice of pillar 3a provider. That still doesn’t answer the question whether pillar 3a makes sense overall. Does pillar 3a through VIAC compete well against our benchmark? Again, this depends on all assumptions. But we can focus on the main drivers. These are:

- The marginal income tax rate

- Whether pillar 3a tax savings are reinvested

- Return assumptions

If you want to see numbers, compare the ‘Final amount’ for different sets of assumptions in the app’s output table.

1. The marginal income tax rate

You need your marginal income tax rate to be high to offset the higher pillar 3a fees. Assume a marginal income rate of 20% (constant over time). If tax savings are not reinvested, even the VIAC 100 solution barely outperforms the benchmark.

Increase the rate to the default values (25% – 35%) and the outperformance becomes much clearer. This is both because of the income tax deductions and the savings on dividend taxes.

2. Whether pillar 3a tax savings are reinvested

Whether tax savings are reinvested has a huge impact on total returns coming from pillar 3a. Be careful with this assumption. My intuition is that the average person investing in pillar 3a won’t reinvest tax savings. They’ll rather increase consumption. Perhaps the average reader of this website is different.

If you set this to true, the compounding effect will kick in for the tax savings. Tax savings will become a sizable portfolio on its own. Pillar 3a will make sense even for very low marginal income tax rates.

3. Return assumptions

All things being equal, the lower the expected the returns, the more sense pillar 3a makes. Why is that? Intuitively, because pillar 3a provides a source of returns – tax savings – that is independent from the markets.

In a way pillar 3a diversifies your earnings. But it also shifts the burden to your income. Pillar 3a returns depend on your marginal income tax rate. Which in turns depends on your income. Returns decorrelated with markets are good when markets do poorly. And bad when markets do great. Hence pillar 3a becomes more attractive if expected returns are low.

Conclusion – is pillar 3a right for you?

My answer – most likely, yes…

My personal answer is yes. For most people, pillar 3a makes sense. Are you a disciplined investor or rather a sporadic investor (a.k.a. speculator)? In either case pillar 3a likely makes sense for you:

- Disciplined investor. If you are disciplined enough to ensure your tax savings are reinvested, pillar 3a will provide superior returns for a very, very vast set of assumptions

- Sporadic investor. Pillar 3a will help you establish good habits (e.g. periodic investments) and force you to keep a long investment horizon

In either case, the higher your marginal income tax rate, the better.

I encourage you to form your own opinion instead of taking this for granted.

… but pillar 3a alone isn’t enough

If you want to take investing seriously, pillar 3a alone isn’t sufficient. Hopefully you can contribute more than CHF ~7k per year to your investments. Learning how to invest outside of the pillar 3a framework is critical. If you don’t invest already, you should head to Investing 101.

Last updated on July 15, 2020

10 replies on “A comparison of pillar 3a alternatives”

Thanks for the helpful overview. I just switched from PostFinance to VIAC. It was a surprisingly smooth process. It took exactly 7 days from the moment I dispatched my request to getting the money on my VIAC account. Also, no Franc was lost on the way in any hidden transactional fees!

Thank you for sharing your experience, Klaudia 🙂

Another solution that might compete well would be finpension:

+ flat Total Expense Ration of 0.39 % excluding Value Added Taxes (VAT) => 0.41964 TER with VAT

+ allegedly no restriction on how you mix the index funds

+ most funds in CHF =>no Foreign Exchange Fees

– currently only as app, website planed for future

https://finpension.ch/en/3a/strategies/index-tools/

Hadn’t heard of this before, thanks for sharing!

I would like to add something about Finpension. Yes, they do let you use up to 99% of foreign currency without hedge (thats also 4% more stock than VIAC).

I asked Viac why they only offer 60% foreign stock and they told me they were not given permission by 3a regulators. I have a feeling they might one day complain to authorities about Finpension using 99%. I am using Finpension but one should know that the max. allocation might change any day.

Im wondering how i should reinvest my tax saving from pillar 3a if i am contributing 6826.- a year to it already.

Does this mean i should open a broker account additionally and reinvest the tax savings in a global spread ETF/s there?

Thanks for clarifying.

That’s correct and also what the model assumes! You can’t increase pillar 3a beyond a certain amount, so you have to invest this elsewhere.

To be clear, I don’t think anyone truly tracks whether they reinvest the Fr. ~2k pillar 3a taxes on a yearly basis. However, if you’re the kind of person who has relatively fixed expenses and invests all remaining savings, then IMO it’s safe to assume you’ll be reinvesting pillar 3a tax savings

Thanks for sharing. By the way, you have the best website on personal finance: unbiased, data supported, references, assumptions. Great job, really. And nice calculation tool! I wanted to create one for myself but you did alread the job 🙂

I think ETF investing has the benefit that one is not forced to cash-out upon retirement. Investments can be adapted over time to suit needs. However if one would compare apple to apple and cash-out ETF upon retirement, over long period of time (depenging on income and gain) it might trigger the 35% capital gain taxation, indirectly making 3a investment even more profitable, what do you think?

Cheers

Thank you for the kind words Bob! Glad you found it interesting 🙂

Honestly I think it’s quite unlikely that an ETF cash-out would trigger capital gains taxes (assuming no margin, no derivatives investing etc. as explained here). At least I haven’t heard of any case myself.

That said, even if this was the case, pillar 3a still wouldn’t be an alternative to avoid that risk. This is simply because pillar 3a scales very poorly (very low max possible contribution per year).

Hi! I love your blog and how you explain things. I really appreciate all the effort you have gone into to explain pillar 3a. I would absolutely love to use your app, but sadly I have not been able to open it. I have tried the two links on chrome, safari, and Edge. Any thoughts on what might be going wrong?

Thanks for your help and everything you do here!